All Revved Up But Nowhere To Go?

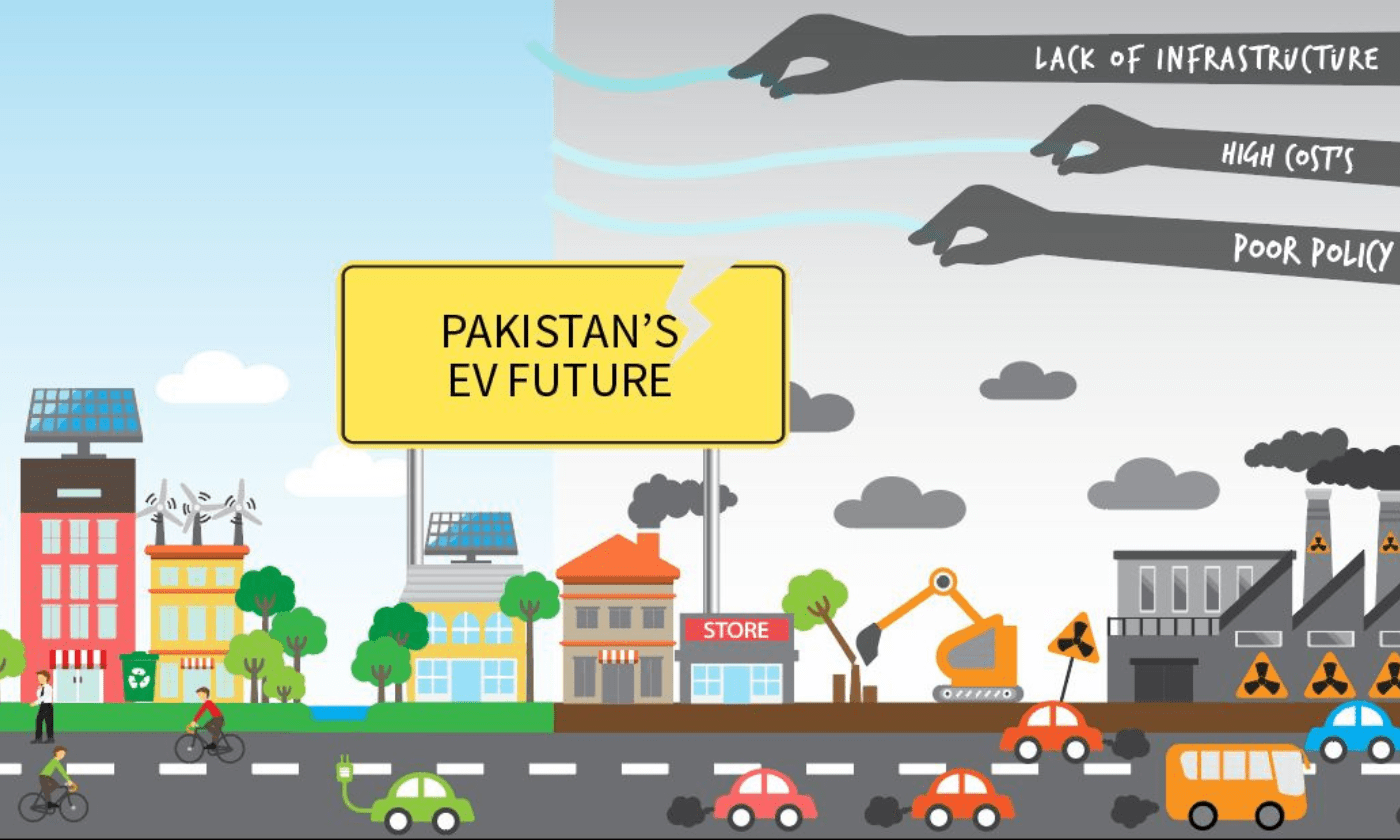

Women, young and old, whirring past you on Chinese-made noiseless electric scooters amidst the chaos of the rattling exhaust pipes of petrol-fuelled vehicles emitting poisonous gases, have lately become a ubiquitous sight on the congested, smoke-filled roads of Lahore. The quiet sound of these scooters, along with the emergence of dozens of showrooms by several Chinese brands, may even lead one to believe that the electric vehicle (EV) revolution is already underway in Pakistan. The growing presence on city streets of hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) of every brand – Chinese, Japanese or Korean – reinforces this impression. But is Pakistan’s transport landscape actually experiencing the ‘electric’ revolution? Many say we are still several years away from the electrification of our transport fleet, be it two- or three-wheelers, cars, or commercial vehicles.

Notwithstanding the surge in demand for electric scooters, mostly among urban middle-class women and students, owing to fuel savings, ease of mobility, and concessional bank financing initiatives introduced by the Punjab and Sindh governments, only a few thousand electric two-wheelers have found their way onto the streets of major cities. The adoption of electric cars, as well as three-wheelers and commercial vehicles, has been even more disappointing.

The upfront costs for an EV scooter or car can be at least two or three times the price of a comparable internal combustion engine (ICE) or petrol-fuelled vehicle. Plus, there are range anxiety concerns, owing to the lack of charging infrastructure in public places, high electricity prices and safety concerns, all of which impede the transition to EV technology. Furthermore, concerns over the absence of a strong secondary market are keeping banks from leasing EVs, despite having prepared financing models.

Chinese car manufacturers argue that a flawed policy framework favouring ‘obsolete’ hybrid technology over electric is hampering the development of the EV market as well as an integrated ecosystem in Pakistan, despite the fuel savings and environmental benefits.

According to Asif Ahmed, GM Marketing at MG Motor Pakistan, “Pakistan’s transition to e-mobility has been painfully slow. EV adoption in the two-wheeler segment has picked up, but the number of pure electric cars on the streets can be counted on one’s fingertips. In total, we may have about 3,000 high-end imported EV sedans, hatchbacks and SUVs on the roads countrywide.”

Yet, as early as 2019, Pakistan had committed to global climate goals and pledged to electrify a substantial part of its transport fleet. In fact, back then, Pakistan had committed to some ambitious climate mitigation and adaptation goals, targeting carbon emissions by adopting renewable solar and wind power and moving towards electric mobility. The government announced its intention to boost the share of EVs to at least 30% of all new passenger cars and heavy-duty trucks by 2030, going up to 90% by 2040. Similarly, the government sought to increase the deployment of electric two- and three-wheelers and buses to 50% and 90%, respectively, in the same timeframe. These goals were later incorporated in the Auto Industry Development and Export Policy (AIDEP) 2021-26. Yet, five years down the road, Pakistan is practically without electric mobility, in stark contrast with the global trend of rapid electrification of transportation.

Umer Khan, a banker with expertise in project and climate financing and who currently heads the investment banking division of the Bank of Punjab, says that in 2024, China accounted for 61%, Europe 24% and the US 11% of the EV cars sold worldwide, with global sales rising by 16% to 13.3 million units from the previous year. The remaining four percent was sold to the rest of the world, including India, where EV adoption is picking up fast.

In comparison to the Chinese, American and European markets, Asia, the Middle East, Africa, and South America have been much slower, and EV penetration in these areas is projected to remain approximately eight per cent. The disparity highlights uneven progress in e-mobility, as the data shows that developing countries are slow in trading petrol pumps for charging plugs, even if the global landscape is buzzing with new possibilities in EV technology.

In Ahmed’s opinion, the high price points at which electric vehicles are available are a major barrier to transition, despite the operational savings and environmental benefits. “So far, only high-end electric cars have been introduced; mostly wealthy people are seeking them as a second or third car.

To ramp up the transition, entry-level cars priced below four million rupees are needed, and that will not happen unless we gear our auto policy towards boosting domestic demand and sales from the present total industry of nearly 152,000 units to at least half a million units a year.“ Added to which, he says, a robust charging infrastructure, especially along highways and motorways, is necessary to address range anxiety, and that a shift from petrol pumps to charging plugs will involve a major lifestyle change for most consumers. “This calls for the acceptance of the new technology, investment in a charging infrastructure on highways and motorways, and government initiatives and subsidies to make EVs affordable to middle-class consumers transitioning from motorcycles to cars.”

The entry of BYD, the world’s largest EV manufacturer and a leader in battery technology, has revved up Pakistan’s EV landscape. BYD has plans to invest $150 million in its assembly plant in Gharo and roll out a large DC fast-charging network. The plant is set to become operational next year in order to take advantage of the tax incentives that the Auto Industry Development and Export Policy (AIDEP) 2021-26 offers to carmakers.

According to Danish Khaliq, VP, Sales and Strategy, BYD Pakistan, the country needs to transition towards the adoption of EVs and PHEVs. The global auto industry is rapidly tilting towards maximum electrification, and traditional hybrids may become obsolete or unsupported in key markets. Investing in EV infrastructure and adoption today will ensure that Pakistan does not lag behind the global technological curve, and although hybrids have their place, the strategic focus should be on accelerating the adoption of fully electric vehicles.

However, given industry concerns regarding the EV policy and low adoption, it is anticipated that BYD, like other manufacturers, will initially focus on introducing PHEVs before fully moving into the EV segment. As Khaliq says, “PHEVs offer the flexibility of both electric and fuel-based driving – providing a practical bridge for consumers and easing concerns about range.”

In his opinion, local manufacturing initiatives will significantly reduce vehicle costs, making new energy vehicles (NEVs) more accessible to a broader segment. “Setting up assembly plants in Pakistan will help bring down some part of the overall cost of the vehicle. We are working towards the inclusion of Mega Motor Company, an associate company of Hubco, into the BYD global supply chain. The question is not if, but when.”

He agrees that range anxiety remains a major barrier to EV adoption in Pakistan. “Charging infrastructure growth needs to dovetail with the growth of EVs.” BYD’s plans to rollout 30 to 40 DC fast chargers by 2026 across the country which will somewhat address the critical infrastructure gap in Pakistan’s EV ecosystem. He also thinks that the lack of understanding of how NEVs work is causing concerns about their safety and reliability. “This ties into concerns over affordability, which are often misunderstood. Many affordability concerns stem from limited awareness, as EVs offer compelling long-term value. As awareness grows around the benefits and technology, we anticipate a sharp increase in consumers transitioning from ICE vehicles.”

The current auto policy has introduced tax incentives for NEVs to keep up with the global shift from the ICE age to e-mobility. The policy targets new investments – initially in completely knocked down (CKD) assembly and later in local manufacturing of EV components. However, although the policy has attracted Chinese carmakers like BYD and several hybrid models, it has not succeeded in pushing the local assembly of pure EVs, let alone building a market for smaller electric cars.

In this respect, Khaliq says the key barrier to expansion is the lack of a consistent and supportive policy framework. In comparable economies such as Thailand and Nepal, the transition to NEVs was driven by structured government policies that created market confidence, attracted investment and spurred consumer demand. “Inconsistencies in Pakistan have constrained the sector’s growth and hindered investor interest. To unlock the full potential of its NEV industry, Pakistan must treat it as a strategic priority – essential to both economic resilience and environmental sustainability.”

Another issue with the current policy is the tax delta (the difference in the total tax burden between CBUs and CKD assembly kits) between completely built-up (CBU) cars and CKDs, making immediate market entry through CBUs difficult. CKD assembly requires a basic threshold in market demand to justify large-scale investments for local manufacturing, and CBUs play a crucial role in building that initial demand by introducing global NEV platforms to local consumers. “Without this stepping stone, technology transfer and access to advanced internationally competitive NEV models is delayed,” says Khaliq. “The tax treatment of NEVs with batteries above 50 kWh is counterproductive, as we should be promoting technologies that cater to a wide audience and allay concerns related to newer technologies. The high-capacity batteries are essential for longer-range NEVs and public transport applications, and a higher tax burden on these batteries impedes the feasibility of assembling such vehicles locally, thereby restricting the range of models that can be introduced in the market. For Pakistan to position itself as a serious player in the regional NEV landscape, the policy must actively incentivise and not penalise the import and local assembly of advanced NEV technology,” he asserts.

Danial Malik, CEO, Master Changan Motors, agrees that consumer concerns, especially around charging infrastructure, are important but are not a “showstopper.” “What should come first, EV cars or charging infrastructure? It is a chicken-and-egg debate. In my opinion, the car has to come first; consumer concerns can be resolved later. But the car will not come unless we have a robust regulatory and policy framework.”

In his opinion, the current automotive policy framework has a strong anti-EV bias. “It incentivises obsolete technologies at the cost of EV technology and discourages the CKD assembly of EVs.” To support his assertion, he points out that hybrid technology attracts an 8.5% sales tax compared to 12.5% and 18% on locally assembled electric cars with batteries below and above 50 kWh respectively.

“The sales tax structure favours hybrid vehicles and inhibits CKD assembly of EV vehicles, small and big, as well as overall EV adoption. No wonder you find new locally assembled hybrid car models launched by all brands. Why invest in CKD in a low-volume market when it is less risky to import, and the current tax structure makes it difficult to take risks on CKD assembly? Why would a consumer pay 9.5% more tax to buy an electric car when they can buy a hybrid model at a lower price? The result is that no one has introduced a decent EV model, and the couple of available locally assembled EV brands have failed to take off.”

He also feels that the auto policy has failed to encourage the introduction of entry-level EVs. “Smaller cars can only be successful when there is a robust charging infrastructure. However, as soon as cars become affordable, adoption will increase and other issues will be resolved – but first, taxes and duties have to come down. Governments across the world support EVs. We don’t need subsidies. We just want the tax differential to be covered to encourage EV adoption through lower prices compared to obsolete technologies.”

Regarding the government’s plans to open up the market to used cars, Malik is of the opinion that although opening the used car market may offer consumers more choice and price competitiveness, this will also impact environmental targets, as consumers may end up buying cheaper, less efficient ICE vehicles.

“The government can play an enabling role in promoting local manufacturing and faster EV adoption by offering policy clarity, long-term commitments, and creating the legal framework for public-private partnerships. We don’t require subsidies; what is needed are regulatory and structural incentives, such as reduced registration fees, lower import duties on components, zero-rating of NEV charging equipment, and green financing programmes.”

Malik concludes that Pakistan is well-placed to become part of the global EV supply chain. “But this has to be a logical, gradual, natural progression. Everything is a business decision. We are the best country to indigenise electric parts due to our close relationship with China. Pakistan has a tremendous opportunity. Our company has plans to localise electric components, and our Chinese partner is supporting us. But we are waiting for a long-term clear policy to invest in.”

Nasir Jamal is the Bureau Chief of Dawn, Lahore. nasirjamal6592@gmail.com

Comments (1) Closed