Living on a prayer

Published in Jan-Feb 2018

When it comes to creative work, not all categories provide the same opportunities. FMCG, tech-based and automobile categories, for example, are more glamorous, dynamic and progressive; whereas others, such as insurance, pharmaceuticals and finance tend to be blander and more resistant to creativity. When it comes to the ultimate black hole in terms of creativity, nothing comes close to the Islamic banking category. Okay, before you start to chase me with pitchforks, I am not insulting the category or what it stands for. I am talking about the way Islamic banking is advertised and the fact that it is not a category that invites creative expression. On the contrary, it is designed to discourage it. Not only does Islamic banking belong to the dry financial category, it is linked to a sacred set of values and beliefs and this explains why agencies and brands are constantly struggling to produce creative and engaging communication that does not contravene the category’s spoken and unspoken conventions.

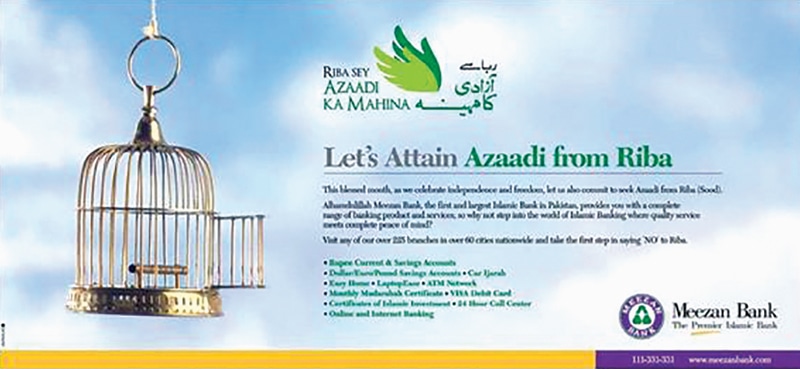

Even if you have never worked on Islamic banking advertising, you have probably seen enough ads to have an idea of how restrictive the category is. One of the greatest obstacles is the visual imagery you are allowed to use in the communication. According to local Shariah boards, the use of people, faces in particular, is strictly prohibited. Some Islamic banks follow this rule to the tee; others allow the occasional hand or silhouette to slip through. Generally speaking, however, people are a no-no in Islamic banking ads and this is why most of them rely on traditional images of mosques, tasbeehs, calligraphy, motifs and other inanimate objects. This is a huge challenge for agencies trying to create a visual differentiation, not least because it eliminates the possibility of establishing any emotional connection with audiences beyond that of faith. Every ad either talks about making the ‘purer choice’ or focuses on the functional proposition of the product. At times, Islamic banking product ads are so generic that they could easily be mistaken for conventional banking ads. Needless to say, it isn’t easy to create engaging and emotional advertising without the use of people. In fact, it is pretty much impossible. It is also not practical to use faith as a basis for every piece of communication without the platform fading into obscurity.

Another barrier to creating distinctive advertising is the sensitivity of the category. Unlike other categories (including conventional banking), where humorous, thought-provoking and more diverse tones in the communication are welcomed to break the clutter, the tonality of the communication remains fairly monotonous. As a category so closely tied to religion, no one in their right mind wants to start a potential firestorm by risking a cheeky caption or quirky visuals that could be misconstrued as disrespectful. Instead, it is better to go with the flow and develop something that is safe, acceptable and within the ‘guidelines’ of traditional Islamic banking ads, which dictate that the more conservative, the better.

With so many restrictions, no wonder most Islamic banking advertisements pretty much all look the same. It also sheds light on why agencies and brands are almost powerless in bringing any change in the way this category is advertised.

I remember seeing a hyper-conservative campaign by Emirates Global Islamic Bank a few years ago in which they showed a bag of money next to fiery flames and a caption that read: ‘Halal or Malaal’. Catchy! Apparently, their fire-and-brimstone strategy was to strike fear and guilt in the hearts of unworthy conventional banking customers (like myself) for engaging in impure banking practices. Pretty extreme for a bank, I would say. I mean, when was the last time a bank told you that you are going to hell unless you start banking the right way? Not exactly the soft-spoken, peace-be-upon-you sales pitch that we are used to hearing from Islamic banks, but still in line with the conservative narrative.

Despite the restrictions, not all banks have followed obediently in the footsteps of the majority. In an effort to break the clutter, some have invested in exploring new creative opportunities in the category. Al Baraka Bank, for example, launched a campaign in 2010 that revolved around their platform of ‘partnership’, featuring refreshing visuals of honeybees, flowers and other ‘natural partnerships’. The approach was unique and immediately helped them stand out from everyone else in the category. In 2012, Standard Chartered Bank refreshed their Saadiq Islamic banking communication with spectacular imagery of forests, sunrays and other natural scenery. Now, I am not saying that there is a direct link between nature and Islamic banking but if you really want to get into the nitty-gritty of it, I suppose there are a thousand ways to perceive nature as one of God’s magnificent creations. More recently, the drive to break the mould was evident in Askari Bank’s 2017 commercial for their Islamic banking brand ‘Ikhlas’. The commercial tells the story of a stressed-out banker succumbing to the pressures of his material-world job and escaping to Istanbul in search of spiritual solace at the Blue Mosque. Setting aside my personal opinion, the TVC shows how desperate agencies and brands are to create unique communication in this category, sometimes even at the expense of realism and relevance.

With so many restrictions, no wonder most Islamic banking advertisements pretty much all look the same. It also sheds light on why agencies and brands are almost powerless in bringing any change in the way this category is advertised. Instead of concentrating on developing engaging communication based on deep insights, agencies and brands spend their time tiptoeing around creative ideas as if they were landmines, afraid of stepping on the one that might blast them into blasphemous oblivion. Even if they do manage to create something different, it is not guaranteed to make sense or resonate with audiences. For the most part, it is just easier (and safer) to stick to the conservative approach and go with the flow.

Yet, as the category continues to evolve, it is possible that we may one day see new creative approaches. I am hopeful that Islamic banks themselves will notice the clutter and start to question why they are investing in advertising that blends into the background. I am also hoping that real research will be conducted in the category that goes beyond the obvious reasons why people prefer to bank the Islamic way. Until that happens, we will have to be patient with the way Islamic banking is advertised and a little more tolerant of all those who attempt to change it.

Taimur Tajik is Executive Creative Director, Manhattan International.

![The [Muslim] consumer and [Islamic] marketing The [Muslim] consumer and [Islamic] marketing](https://i.dawn.com/thumbnail/2017/04/58e60a3ec069b.jpg)

Comments (1) Closed