The Transition Momentum

Today, globally, one of every four cars sold is an electric vehicle (EV). A decade ago, according to the International Energy Agency, that number was one in 125. So, what is the next decade likely to bring, and will EVs eventually pose an existential threat to conventional internal combustion engines (ICEs)?

Here, let us pause and look at what is happening in Saudi Arabia, the de facto leader of The Organization of the Petroleum Exporting Countries (OPEC), the oil cartel that has long influenced global petroleum flows and, by extension, the world’s energy economy. As part of the Kingdom’s Vision 2030, Saudi Arabia is aggressively diversifying from oil into sectors such as tourism, sports and renewable energy. This explains social transformation as dramatic as bending marriage laws to allow football star Cristiano Ronaldo to live with his girlfriend – unthinkable in the past. But this was not about accommodating a celebrity but rather an indication of a broader shift: oil is no longer Saudi Arabia’s foundation of economic relevance.

In Pakistan, however, an EV is still a sight that turns heads, even if hybrids have become a lot more common, and it seems likely that a structural move from fuel-based mobility will only take root when mass adoption begins in the two- and three-wheeler segment, followed by heavy and light commercial vehicles. This is where the mass market lies, and EVs will remain a niche phenomenon until that segment begins to shift. Not that the government is not working hard to effect a shift that could potentially be the key to unlocking growth. In fact, the New Electric Vehicle Policy (NEVP) 2025-30 is aimed at gearing Pakistan up for an EV revolution at par with other developing countries. That path, however, is far from smooth.

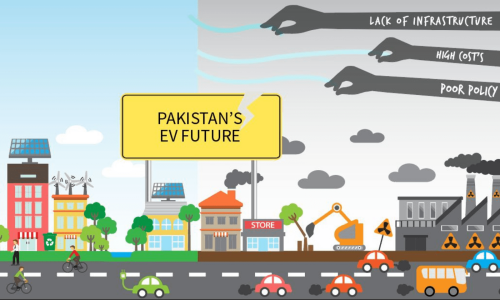

For starters, according to Syed Asif Ahmed, GM, MG Motors Pakistan, the country’s automotive market is dominated by Japanese brands; a dominance that explains why hybrid electric vehicles (HEVs) are expected to gain more traction than fully electric vehicles. Then there is the strong influence of traditional automakers so that although the NEVP 2025-30 policy signals a push toward electrification, entrenched ICE manufacturers are nevertheless digging in their heels. “There is a strong influence of conventional automakers over the NEV policy. EV technology is disruptive and ICE manufacturers are trying their best to avoid becoming a Kodak or a Blackberry,” says Ahmed. Their tactics include seeding misleading information and manipulating policy to delay EV adoption.

In this context, hybrids are the classic wolf in sheep’s clothing, says Ahmed. They have lobbied to benefit from almost the same policy benefits as EVs, despite running on petrol (especially at high speeds on highways). In fact, Pakistan is the only country where hybrids are priced significantly higher than the fuel savings they supposedly offer. On average, a hybrid car is three million rupees more expensive than its gasoline counterpart, with a breakeven time stretching beyond 12 years. In this respect, Pakistan loses twice: first by importing hybrids and second by granting them lower duties, while the promised fuel savings remain largely a myth. Logically, says Ahmed, the fuel savings should match or exceed the price differential, but in Pakistan, they do not.

The Engineering Development Board, operating under the Board of Investment, has also taken several steps to incentivise local EV production. However, although some local players have dipped their toes in these waters, none have committed to full-scale local assembly because the lack of demand is preventing automakers from scaling. Another reason is the lower duty imposed on completely built-up (CBU) EV imports and which makes local production financially unattractive.

Complicating matters further is the possible relaxation, under IMF guidelines, of import restrictions on used cars; something that, warns Ahmed, could turn Pakistan into a “global garbage bin” for old vehicles. The fact is that although imports of used cars may help consumers in the short term, they do nothing to stimulate local manufacturing or innovation.

Yet, despite these problems, there is momentum. A group of Chinese companies has pledged to invest $340 million in Pakistan’s EV sector, targeting both the manufacturing and the charging infrastructure. BYD, the world’s largest EV maker by sales, entered Pakistan last year through a partnership with Mega Motors. The company has already established a presence in Karachi with a gleaming showroom at the recently renovated historic hotel Metropole building and has launched four sales and after-sales service outlets across Pakistan.

Given the momentum and the government’s keenness to electrify the country’s transportation system, EV adoption is not so much a matter of if but of when. For example, although Honda was initially cautious and slow to respond to the EV call, it is now projecting that 100% of its global sales will be electric by 2040. Suzuki has followed a similar trajectory. Late to the EV game, it is now focusing on emerging markets like India, where it launched its first EVs last year, and by FY 2030-31, it plans to have six models on the road, and Maruti Suzuki has committed to building a robust charging network, aiming for a station every five to 10 kilometres.

As the global auto giants are making their move towards EV and their Pakistani operations will inevitably follow. However, all this hinges on one critical element – infrastructure, and so far, the EV ecosystem in Pakistan is stuck in a classic chicken-and-egg dilemma. There are few EVs because there are few charging stations, and there are few charging stations because there are few EVs. Without breaking this cycle, growth will be sluggish at best.

To its credit, the government has issued 57 licenses for EV manufacturing this year alone, 55 of which are for two- and three-wheelers. On paper, this should mean that our roads will soon be flooded with electric scooters and motorcycles. Yet despite being available for years, electric two-wheelers are conspicuously rare on our streets. The immediate issue, it appears, is the cost and vulnerability of EV batteries – the most expensive components in an electric two-wheeler.

Yet, despite the unresolved challenges, given that the rest of the world is well on its way to transitioning to EVs (and they are facing challenges), Pakistan will also eventually do so, all well, if only because there is no other option.

Fatima S. Attarwala heads Dawn’s Business & Finance desk and is a host of the podcast All Things Money. fatima.attarwala@dawn.com

Comments (2) Closed