An Iconic Jingle Makes a Comeback

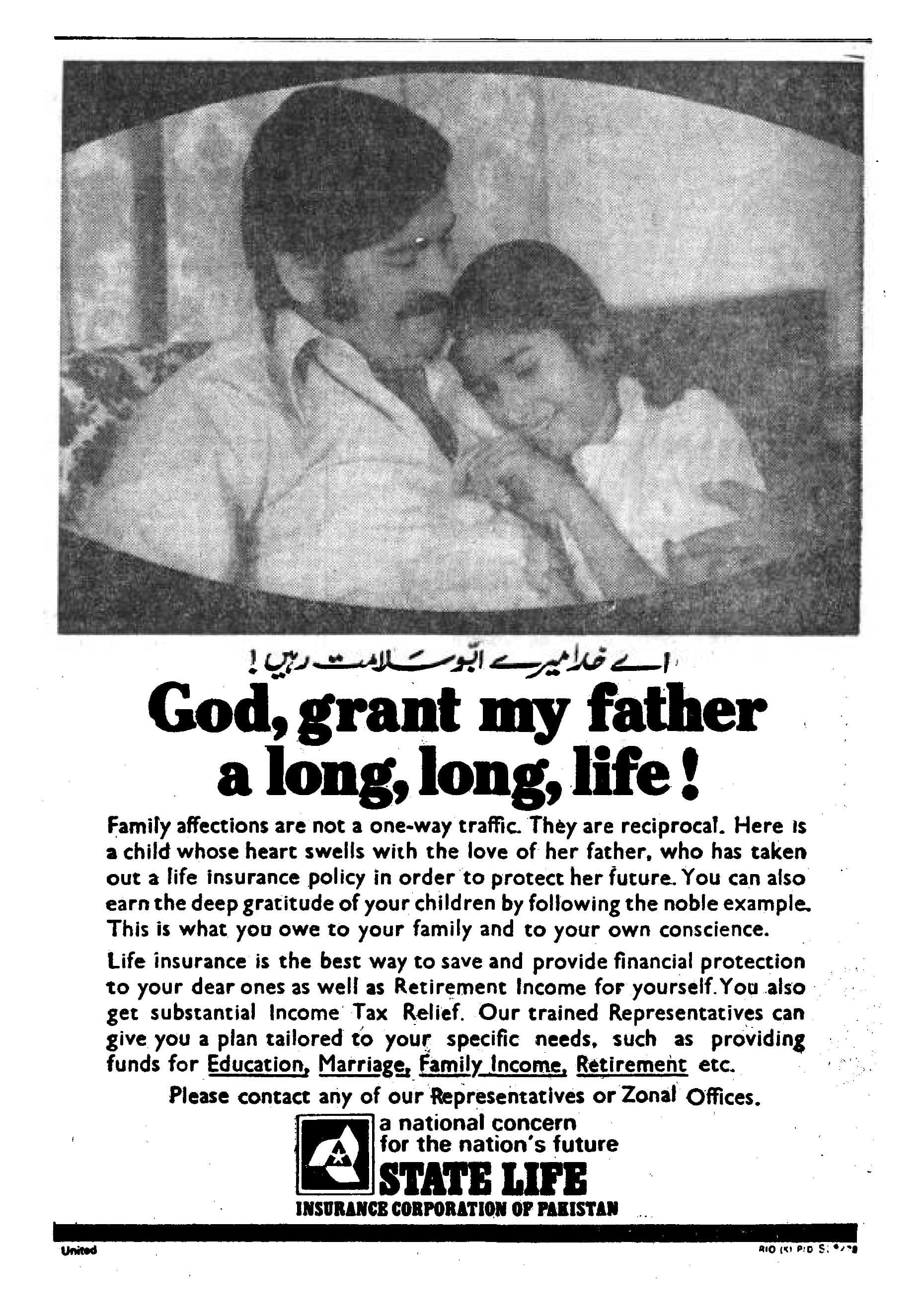

When most people talk about the iconic jingles of Pakistani advertising, State Life Insurance’s “Ae Khuda Mere Abu Salamat Rahain” from the eighties always comes up. Perhaps this is why the company chose to revisit it for their 50th anniversary.

However, several changes were made to the jingle and although the tune is similar, this time it is Shehzad Roy who sang the lyrics, which have been modified with the addition of two important lines: “Ae Khuda meri Ammi salamat rahain” (an ode to mothers) and “Ae Khuda meri dharti salamat rahe” – a tribute to Pakistan.

The new TVC pays tribute to both parents who dedicate themselves to the betterment of their children’s lives (with different forms of insurance), as well as to Pakistan while emphasising the fact that State Life has been the country’s “insurance partner” for the past 50 years.

Explaining the concept behind the campaign, Khalid Mahmood Shahid, GM Marketing, State Life Pakistan, says “We wanted to revive the nostalgia the classic jingle evokes while giving it a more upbeat spin. We also wanted to create awareness about insurance products on a national level and establish that we have been the country’s trusted insurance partner for 50 years.”

The TVC is part of a wider 360-degree campaign that aims to help people understand the concept of insurance and ultimately take it up. Pakistan has one of the smallest insurance markets in the world, and although industry-wide efforts have been made to increase penetration, it currently stands at 0.9% – much lower compared to the world average of approximately 3.5%. This is due to limited innovation in driving consumer demand, a lack of trust in financial institutions and a long-standing ‘morbid’ connection between insurance products and death.

Moreover, Pakistan’s insurance industry is largely dependent on a field network of agents; most companies direct a major chunk of their marketing budgets towards developing agent teams, rather than opting for regular marketing initiatives. It is only recently that State Life, along with a few other players, have started investing in regular ad campaigns.

The current campaign is running on all major TV channels, radio stations, newspapers, magazines and digital media. The response has been promising and, according to Abdul Qadir Shah, Chief Executive, Connect Marketing Communications (State Life’s agency), #AeKhudaMereAbu was trending on Twitter for two days after the ad was released.

Zakaullah Khan, Creative Director, Connect Marketing Communications, elaborates by saying that “the objective was to refresh the connection between State Life and the people of Pakistan.” The other goals were to build brand equity, leading to top of mind recall and favourability for the brand.

The agency’s research showed that the mention of “Abu” alone was not enough, because the idea of who the breadwinner is in a family has changed, hence the addition of the line related to mothers. The agency initially wanted to include other relations – such as uncles, aunts, brothers and sisters – but there wasn’t enough time and it would have taken away the emphasis from the word “dharti”.

According to Khan, an active effort was made to differentiate the current campaign from the original one by using new lyrics and melodies. He says that it is only when the key line “Ae Khuda mere Abu” is vocalised that audiences link the old and new TVCs.

Speaking on the challenges of reviving the old TVC, Khan says “We tend to look at the past through rose – or perhaps gold – tinted glasses as in this case the TVC celebrates our golden anniversary. This is why living up to the original jingle was always going to be a challenge; the past campaign has become larger than life in the minds of our consumers.” He adds that while the original campaign focused on changing perceptions that insurance is only useful in the case of someone’s death, the current objectives are to increase brand recall among a wider range of consumers.

According to Shahid, State Life’s market share stands at 60%, up from 50% two years ago. “This proves that the market has the potential to grow,” especially with the introduction of custom products such as the Sinf-e-Aahan insurance policy, which provides financial cover to female cancer patients at affordable premiums. Going forward, State Life is set to introduce more such products which can be used by more and more people.

Comments (1) Closed