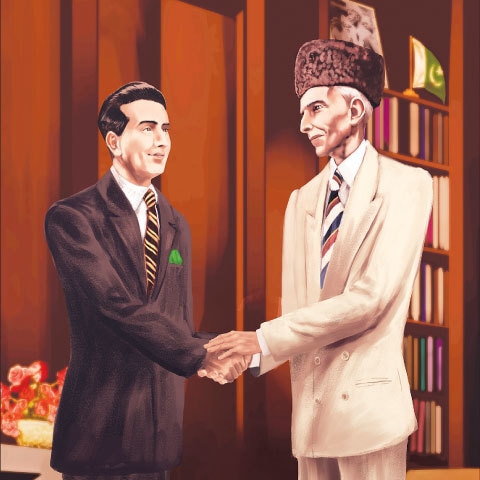

On Pakistan Day (March 23, 2020), HabibMetro Bank (HMB) rolled out a campaign to celebrate their legacy called Quaid Ke Habib. The campaign centred on the contribution made by Mohamedali Habib, the founder of HMB (he also founded Habib Bank Limited [HBL]) to Pakistan’s banking history as well as his role as a close aide (habib) of Quaid-i-Azam Mohammad Ali Jinnah. The campaign (print and digital) further focused on Mohamedali Habib’s role in helping people who had migrated to Pakistan to transfer and manage their financial assets and depicts him presenting a blank cheque as a symbol of his support.

According to Sheeza Ahmed, VP, Marketing & Corporate Communications, HMB, “Habib is such a beautiful word. Everyone wants a ‘habib’ in their lives – a loved one to look after and care for them – and that is what Mohamedali Habib did for Pakistan. Our intention was to focus on this aspect to communicate the bank’s legacy to Millennials. The concept stems from our history. We are unique in the sense that although we have been operational since 1992, our legacy dates to 1941 when Mohamedali Habib established HBL in Karachi. For a mid-sized bank such a history is unique and we wanted to communicate this to our customers.”

Ahmed adds that given that there are quite a few Habib banks operating in Pakistan – HBL, Bank Al-Habib, HMB – it is easy for customers to get confused and another objective of the campaign was to establish a distinction. For context, HMB was established in 2002 (it was initially called Metropolitan Bank) by the House of Habib which was established in 1841. Later, in 1976, the group established Habib Bank AG Zurich in Switzerland and in 2006, Metropolitan Bank merged with Habib Bank AG Zurich’s Pakistan operations and was renamed Habib Metropolitan Bank, now known as HabibMetro Bank. Furthermore, although HBL and HMB share the same founder, they are not affiliated in any way.

Today, HMB has nearly 400 branches spread across 134 cities in Pakistan and its expertise lies in trade finance, principally acting as a financial intermediary between local and international companies in the import and export businesses. Within the trade finance category HMB leads the market with a share of 14%. As far as consumer banking is concerned HMB has a very limited share of just two percent.

Ahmed says that the bank is not a mainstream commercial bank and “our focus is on trade finance and the SME sector. However, going forward, we will be targeting retail businesses and consumer banking and the current campaign is aimed at achieving a more diversified product spectrum in the longer term.”

Noteworthy is the fact that HMB decided to go ahead with the campaign despite the Covid19 crisis. “Although we may decide to delay other product related campaigns that are in the pipeline, we went ahead with this campaign because we wanted to start the year with a strong corporate communication.” Ahmed adds that HMB have contributed to the Prime Minister’s Relief Fund (Ehsaas Emergency Cash Program) for people affected by coronavirus.

Looking at the overall economic situation, she is of the opinion that brands cannot afford to go silent at such times and that HMB aims through various mediums – be it digital and print – to continuously communicate with their customers and reassure them that better days will come, and when they do, HMB will be ready to be part of their journey as their financial partner.

![Ali Suleman Habib [1956-2020] Ali Suleman Habib [1956-2020]](https://i.dawn.com/thumbnail/2020/07/5f19516bdef58.png)

Comments (0) Closed