An industry in waiting

Published in Sep-Oct 2012

Pakistan’s dairy industry, ranked as one of the largest in the world, is also the third largest producer and consumer of liquid dairy products (LDPs) globally.1

In 2009 alone, Pakistan produced over 34 million tonnes of milk.2 Consequently, the sector is a vital driver of the economy, with over 10 million farming households making a GDP contribution of over 11%.

Yet despite these robust figures, the sector is largely unstructured, characterised by fragmented, smallholder farmers operating at subsistence levels. As a result, unprocessed milk still represents almost 94% of all LDPs consumed in Pakistan.[3]

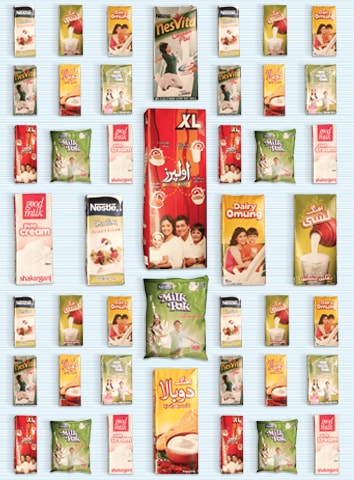

In the formal dairy sector, five broad product segments operate in the LDP market. In 2009, of a total volume size of 808 million litres of LDP, white milk accounted for 72.8% of the market volume, tea creamers for 22.3%, flavoured milk for 2.4% and liquid cream for 1.7%. The remaining 0.8% consisted of low fat milk products.

Loose milk accounts for 62% of the total dairy supply directly sold to consumers. According to a study conducted in 2009,[4] approximately 38% of the total milk supply procured by milk purchasers/milk collection centres was used to produce milk by-products such as yoghurt, cheese, butter, khoya, ghee and flavoured milk. In Punjab, yogurt is the most popular dairy by-product in terms of production with almost 113kg produced daily by local milk centres and accounting for 90% of all production. The rest of the 10% is made up of five other by-products: butter, cheese, flavoured milk, ghee and khoya.

Challenges

Pakistan’s dairy industry is largely underdeveloped, mainly due to outdated milk procurement and distribution methods followed by dairy farmers. Milk productivity faces constraints from the low genetic potential of local milk producing animals. Fodder with inadequate nutritional value, including dirty and limited water is a principal cause of poor livestock production. The affordability of cattle feed is another big problem, added to which livestock farmers are known not to pay heed to animal housing, exposing their cattle to external elements that adversely affect the yield of their livestock.

Another major challenge is the lack of proper cold chain facilities and given the fact that most dairy farms are located away from city centres, it is increasingly difficult to supply milk as soon as it is obtained from the livestock. Milk requires to be kept under a temperature of four degrees centigrade, otherwise the bacteria multiply. On average it takes eight to 24 hours for the milk to reach consumers from the dairy farms and given that most rural milkmen lack the refrigerated transport to control the temperature of their dairy supply, they inevitably end up adding adulterants like ice, formaldehyde, caustic soda and urea to preserve it. Even worse, when this concoction is boiled by the end-consumers (a practice proven to destroy the nutritional value of milk), these chemicals tend to remain in the milk, posing a potentially dangerous health risk.

####In 2009 alone, Pakistan produced over 34 million tonnes of milk. Consequently, the sector is a vital driver of the economy, with over 10 million farming households making a GDP contribution of over 11%. Yet despite these robust figures, the sector is largely unstructured, characterised by fragmented, smallholder farmers operating at subsistence levels. As a result, unprocessed milk still represents almost 94% of all LDPs consumed in Pakistan.

To overcome some of these challenges, Tetra Pak and its customers, introduced a rural community dairy development programme called the Dairy Hub [Pakistan’s first Dairy Hub was established by Engro Foods in collaboration with Tetra Pak in 2009], which typically brings together 15-20 villages with 800-1,000 smallholder farmers, and up to 10,000 milk animals – cows and buffaloes. By treating cows from several villages as a single herd, economies of scale are created enabling a focus on feeding, breeding, animal health and training. The dairy farmers work in close cooperation with dedicated dairy processors, which have set up a number of milk collection points with milk cooling tanks, where the farmers can deliver their milk every day.

A bright outlook

According to research conducted by Tetra Pak, low income consumers in developing markets such as Pakistan, represent sizeable opportunities for dairy companies. Described as Deeper in the Pyramid (DiP) consumers, they represent about 50% of the combined population of all developing countries. In developing countries, consumption of dairy products by DiP consumers is expected to grow from about 72.5 billion litres in 2011 to almost 80 billion litres in 2014[5].

In Pakistan the challenge is to reach DiP consumers given that 94% of Pakistanis consume unpackaged milk and 70% of them live in rural areas. However, local food processors are coming up with innovative and affordable new products to reach this lucrative market. For example, tea creamers are inexpensive and offer huge potential as drinking milk with tea accounts for 32% of total milk consumption in Pakistan. The product, based on vegetable fat, is an affordable alternative to UHT and powdered milk. This has facilitated penetration into smaller retail channels reaching DiP consumers. Currently tea creamers represent over 25% of the LDP market, with an expected growth rate of 28% from 2009 to 2012.

Given that Pakistan’s population is growing by 1.7% year-on-year, the consumption of LDPs is expected to grow at a rate of 2.8% from 2009 to 2012.[6] As demographic changes and changing consumer lifestyles drive new preferences consumers will turn towards dairy products that are safe, provide better value for money and are more convenient to use.

1 . Tetra Pak Dairy Index, Issue 5

2 . Food and Agriculture Organization (FAO) Statistical Yearbook 2010.

Table B.12 – Production of milk and eggs

3 . Tetra Pak Dairy Index, Issue 3

4 . Analysis of milk production system in peri-urban areas of Lahore (Pakistan).

A case study by Hamid Jalil, Hafeez-ur-Rehamn, Maqbool H. Sial and Syed Shahid Hussain, 2009

5 . Tetra Pak Dairy Index, Issue 5

6 . Tetra Pak Dairy Index, Issue 3

Ayesha Eirabie is Communications Director, Tetra Pak.

ayesha.eirabie@tetrapak.com

Comments (0) Closed